If you run a subscription business, churn is the silent leak in your bucket. I have led growth teams at SaaS companies and learned this the hard way. In simple words, what is churn rate in SaaS? It is the share of customers or revenue you lose over a period. Know it. Track it. Fix it. This guide will show you how, with clear steps and real stories.

What Is Churn Rate In SaaS?

Churn rate is the percentage of customers or revenue that cancel or downgrade in a set time. You can track customer churn (logos lost) and revenue churn (MRR lost). Both matter. Customer churn tells you adoption. Revenue churn shows impact on cash flow.

For subscription companies, small swings compound fast. A 1% change each month adds up over a year. Think of churn as gravity. If you do not fight it, it pulls growth down.

When people search for what is churn rate in SaaS, they want a clear answer. Churn is the rate at which users or dollars leave your product. That is it.

Why Churn Matters To Growth And Valuation

Churn shapes lifetime value, unit economics, and runway. Investors watch churn like a hawk. Low churn means strong product-market fit. High churn signals friction, poor onboarding, or weak fit.

Here is the impact in plain terms:

- Lower churn boosts LTV and lets you spend more on CAC.

- It smooths cash flow and reduces pressure on sales.

- It increases expansion potential and net revenue retention.

I have seen companies with 2% monthly churn grow on autopilot. I have also seen 8% churn kill momentum, even with great top-of-funnel.

How To Calculate Churn Rate (With Formulas And Examples)

There are two core ways to measure churn: customer churn and revenue churn. Use both.

Key formulas:

- Customer churn rate = customers lost in period / customers at start of period

- Gross revenue churn rate = MRR lost from churn and downgrades / MRR at start

- Net revenue churn rate = (MRR lost from churn and downgrades − MRR expansion) / MRR at start

- Net revenue retention (NRR) = 1 − net revenue churn rate

Simple example:

- Start of month: 1,000 customers, $100,000 MRR

- Lost 40 customers, $6,000 MRR from churn and downgrades

- Expansion added $4,000 MRR

Results:

- Customer churn rate = 40 / 1,000 = 4%

- Gross revenue churn = $6,000 / $100,000 = 6%

- Net revenue churn = ($6,000 − $4,000) / $100,000 = 2%

- NRR = 98%

Tip from experience: Always time-bound and cohort-based. Monthly for early stage. Both monthly and quarterly for later stage.

Types Of Churn You Must Track

Not all churn is equal. Split it to learn faster.

Track these:

- Voluntary vs involuntary churn Voluntary is when users cancel. Involuntary is failed payments and card issues.

- Gross vs net churn Gross ignores expansion. Net includes upgrades and add-ons.

- Logo churn vs revenue churn Logo counts people. Revenue weights by dollars.

- Cohort churn Track by signup month, plan, segment, or channel.

- Product-level churn See which features, seats, or SKUs drive loss.

In my teams, this breakdown exposed hidden problems. One case: logo churn was flat, but revenue churn rose from downgrades on a specific plan. We tweaked packaging and fixed it in two cycles.

Common Causes Of Churn And How To Spot Them

Churn is a symptom. Here are common roots and signals.

Causes:

- Poor onboarding Users never see value in week one.

- Weak activation Time-to-value is too long.

- Bad fit The product solves the wrong job for the segment.

- Pricing misfit Users feel price is higher than value.

- Product gaps Missing features for key use cases.

- Support friction Slow replies or complex workflows.

- Seasonal or contract changes Budget cuts, team changes.

How to spot:

- Heatmaps and session replays show where users get stuck.

- Event data points to broken paths in the first 7 days.

- Exit surveys reveal why users leave in their own words.

- NPS and CSAT identify unhappy cohorts before they churn.

- Billing logs find involuntary churn you can recover.

A quick win I used: Add a short cancel flow survey with 5 choices and one open text. Auto-tag the reasons. It gave us a clear top-3 to fix each quarter.

Proven Ways To Reduce Churn

Start with activation. Then improve value delivery. Then address payment failures. Work the list in order.

Practical steps:

- Speed up time-to-value Use checklists, templates, and in-app guides.

- Personalize onboarding Match paths by role, industry, and goal.

- Build sticky habits Send useful alerts, weekly summaries, and reminders.

- Engage high-risk users Trigger help when usage dips for 7 days.

- Improve packaging Make upgrade paths clear and fair.

- Save at the edge Add rescue offers in cancel flows for win-backs.

- Fix failed payments Use dunning emails, card updaters, and smart retries.

- Delight with support Offer fast chat, strong docs, and office hours.

One story: We cut churn 25% by focusing on first-week success. We added a setup wizard, a welcome video, and a 15-minute kickoff call for high-ACV trials. The change paid for itself in a month.

Measuring, Tooling, And Reporting Best Practices

Good data beats guesswork. Make measurement simple and reliable.

Do this:

- Define events Track signups, activation, key actions, and cancellations.

- Use cohorts Analyze by month, plan, and channel.

- Build a churn dashboard Show logo churn, gross churn, net churn, NRR, and payback.

- Standardize formulas Document start counts, reactivations, and grace periods.

- Close the loop Tag churn reasons and push to product backlog.

Tools to consider:

- Product analytics for events and funnels.

- Billing systems for MRR, downgrades, and dunning.

- CRM and CS platforms for health scores and playbooks.

- Data warehouse and BI for a single source of truth.

Report cadence:

- Weekly for leading indicators like activation and usage.

- Monthly for churn and NRR.

- Quarterly for deep dives and roadmap changes.

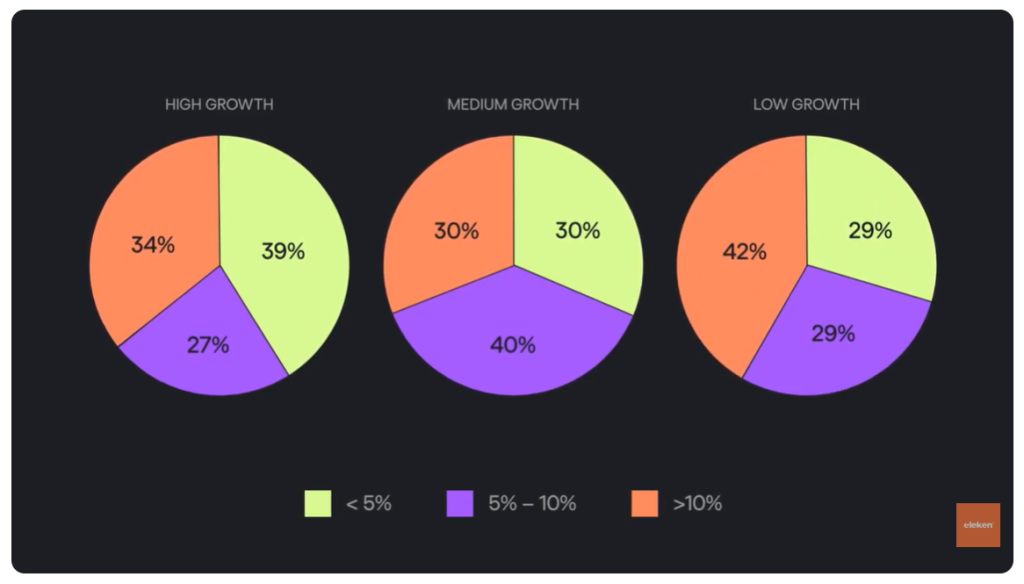

Benchmarks, Targets, And How To Set Goals

Benchmarks vary by market, price, and stage. Use them as guides, not rules.

Common ranges seen in the industry:

- B2B SMB monthly logo churn: 3% to 7%

- B2B mid-market monthly logo churn: 1% to 3%

- Enterprise annual logo churn: 5% to 10%

- Healthy NRR targets: 100% to 120%+ depending on segment

Goal setting tips:

- Start with current baseline and segment by plan.

- Pick one lead metric to improve, like day-7 activation.

- Tie initiatives to a measurable change in churn reasons.

- Run 90-day experiments and review outcomes.

- Celebrate small gains. A 0.5% monthly drop is big over a year.

Be transparent with your team about limits and noise in the data. Seasonality and product launches can skew churn. Control for those factors when you can.

Frequently Asked Questions of what is churn rate in saas

Q. How do I choose between customer churn and revenue churn?

Track both. Customer churn shows how many accounts you lose. Revenue churn shows the dollar impact. For high-variance plans, revenue churn tells a truer story.

Q. What time frame should I use for churn?

Use monthly if you sell monthly plans. Use quarterly for annual contracts. Early-stage teams benefit from monthly tracking to learn fast.

Q. Is negative churn real?

Yes. When expansion MRR is greater than lost MRR, net revenue churn is below zero. This drives NRR above 100%, which fuels compounding growth.

Q. How do I reduce involuntary churn?

Use smart dunning. Send card update links. Add automatic card updaters. Retry payments with a schedule that respects bank rules. Notify users in-app before cards expire.

Q. What is a good churn rate for SaaS?

It depends on your segment. Many healthy B2B SMB tools aim for 3% to 5% monthly logo churn or less. Mid-market aims lower. Use your own baseline and improve it over time.

Q. Should I count reactivations?

Count them as new revenue for MRR. For churn rate, do not net them against cancellations in the same period. Keep counting clean to avoid masking issues.

Q. What are the best early warnings for churn?

Drops in weekly active usage, missed key actions, and support tickets without fast replies. Watch for login decay in the first 14 days and act fast.

Conclusion

Churn is not a mystery. It is a metric you can measure, manage, and move. Define it. Track it by cohort. Fix activation. Win back at-risk users. Keep your value front and center.

Treat churn like a daily habit, not a quarterly fire drill. Start small this week. Pick one step from this guide and ship it. Then review the data and repeat.

If this helped, subscribe for more guides, share your story in the comments, or explore our related resources.